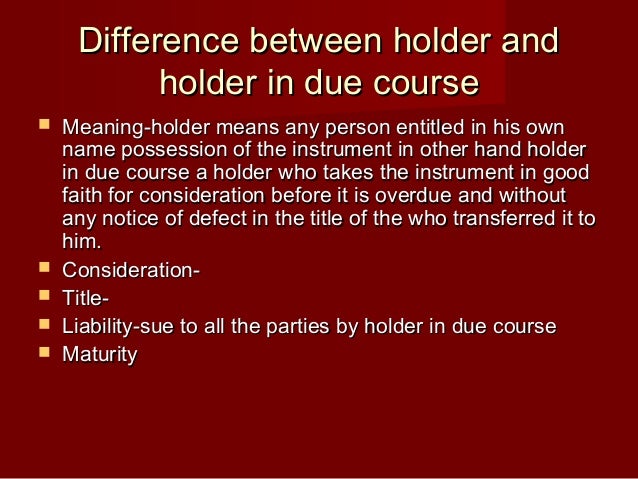

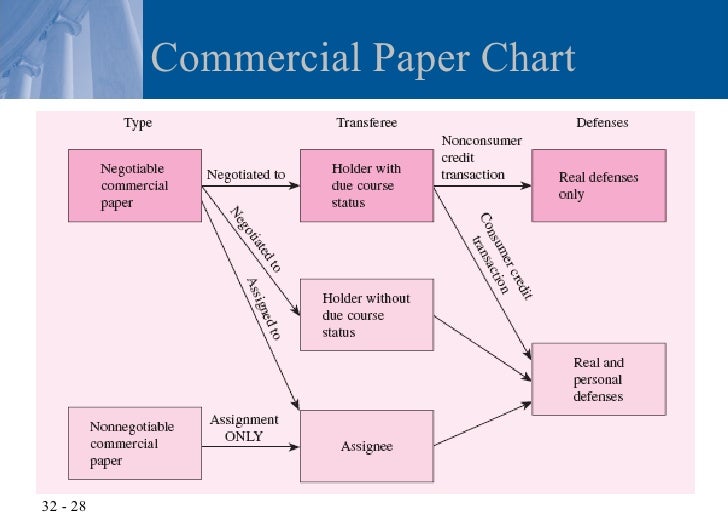

Issue: Placing a Stop Payment DOES NOT eliminate your obligation to pay the check To receive the long version of these cases, email Robin Johnson: J. Three Federal Appellate Court cases illustrate the far-reaching power of Holder in Due Course. “Void After XX Days,”), the recipient/purported “Holder” has no legal standing as a Holder In Due Course, and cannot claim that legal status. If the check had expired (due to the statute of limitations or due to a statement on the face of the check specifying when the check expires, e.g. The new Holder has the same legal rights to the check as the original Holder, and can sue the drawer of the check for the face value of the check, provided that the check had not “expired” prior to the original Holder accepting the check for payment. A Holder can assign, sell, give, or otherwise transfer its rights to another party, as long as the third party wasn't involved with any underlying fraud pertaining to the check. The statute of limitations for a Holder to sue the drawer is 10 years from the issue date, or three (3) years from the date the check was deposited and returned unpaid, whichever comes first. If a recipient (the Holder) is unable to negotiate the check, the Holder can sue the drawer (the check issuer) for the full face value of the check, and get a judgment against the drawer. This is true even if the drawer placed a stop payment on the check, or if the check was rejected at the bank as a Positive Pay exception item. Under the UCC, the recipient of the check is an HIDC and is entitled to be paid for the check. On the face of the check there cannot be any evidence of fraud, nor can the person accepting the check have knowledge of any underlying fraud related to the check. In simple terms, a Holder in Due Course is anyone who accepts a check for payment.

The following is a brief explanation of Holder in Due Course. After learning about HIDC claims, prudent companies are often motivated to use high security checks and change check disbursement procedures to protect themselves. Holder in Due Course (HIDC) is part of the Uniform Commercial Code (UCC) that significantly impacts an organization’s liability for check fraud and the checks it issues.

0 kommentar(er)

0 kommentar(er)